Charting the Housing Market

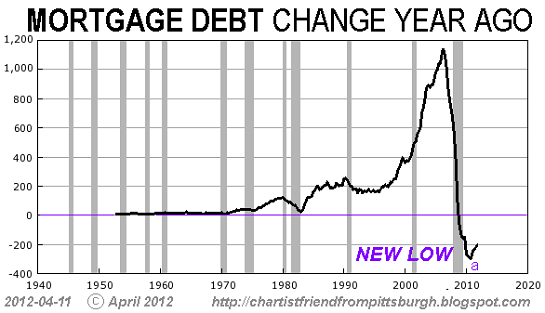

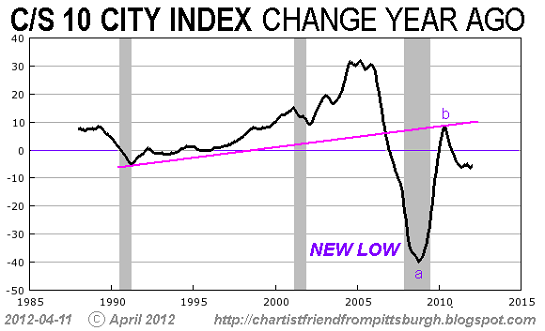

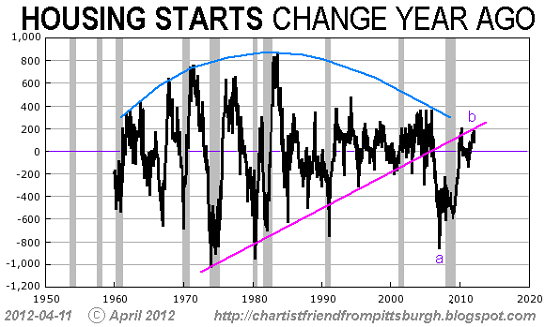

By a number of measures the housing market has not recovered.

I asked frequent contributor Chartist Friend from Pittsburgh to apply his technical insights to the housing market. His charts and observations are illuminating:

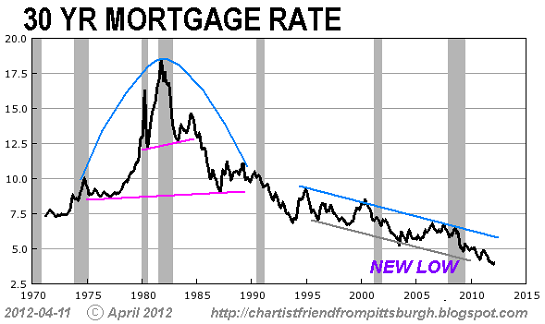

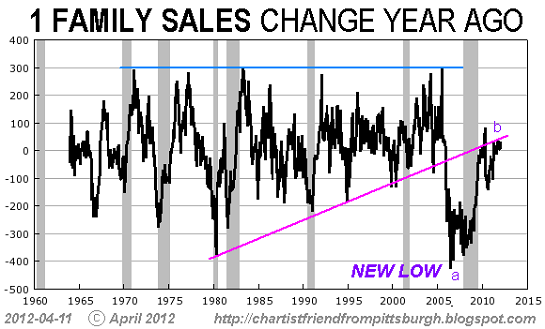

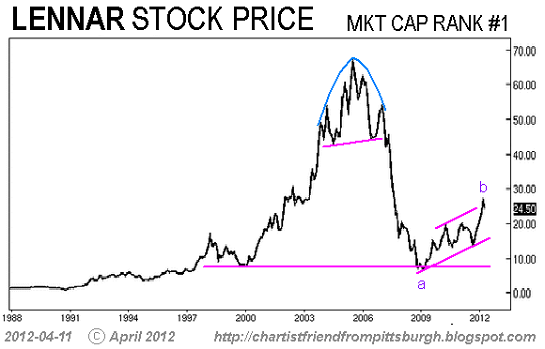

I've looked at the charts a little further, and the pattern that emerges is this: fatal collapse - attempt at resuscitation - imminent reading of the last rites.In technical terms that would translate to "a" wave breakdown (in most cases to new lows), "b" wave correction/pullback to previous support neckline, then "c" wave to lower lows.

It saddens me to have to report that, even with mortgage rates at historic lows, the American housing market is dead.

Planning your spring garden? Longtime oftwominds.com supporter Everlasting Seeds has a deal for you. At my request, Everlasting Seeds prepared a variety pack of non-hybrid seeds just for small gardeners like myself. If you've never planted a garden but always wanted to give it a try, this is the perfect opportunity to get started. Longtime gardeners will enjoy trying a different mix of veggies.

Contains 30 seeds of each: Corn Broccoli Pea Onion Radish Carrot Cabbage Tomato Cauliflower Spinach Lettuce Pole Bean

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: though our financial system seems unsinkable, its reliance on debt and financialization has already doomed it.We cannot know when the Central State and financial system will destabilize, we only know they will destabilize. We cannot know which of the State’s fast-rising debts and obligations will be renounced; we only know they will be renounced in one fashion or another.

The process of the unsustainable collapsing and a new, more sustainable model emerging is called revolution, and it combines cultural, technological, financial and political elements in a dynamic flux.History is not fixed; it is in our hands. We cannot await a remote future transition to transform our lives. Revolution begins with our internal understanding and reaches fruition in our coherently directed daily actions in the lived-in world.

| Thank you, Daniel D. ($100), for your outrageously generous contribution to this site--I am greatly honored by your support and readership. | Thank you, Martin H. ($25), for your exceedingly generous contribution to this site--I am greatly honored by your support and readership. |