The dwindling middle class, squeezed by higher taxes and costs, is losing its political voice.

By assembling price and wage data stretching back hundreds of years, Fischer found that cycles of economic growth spawned population growth, an expanding number of workers entering the market economy (as opposed to the non-market subsistence economy) and a demand-driven expansion of essential commodities such as grain and energy (wood, coal, oil, etc.).

In the initial phase, wages rise and commodity prices remain stable as supplies of essential goods expand and the demand for labor pushes up wages.

But this virtuous cycle reverses when the supply of essentials no longer keeps pace with rising population and demand: the price of essentials begin an inexorable rise even as an oversupply of labor drives down wages.

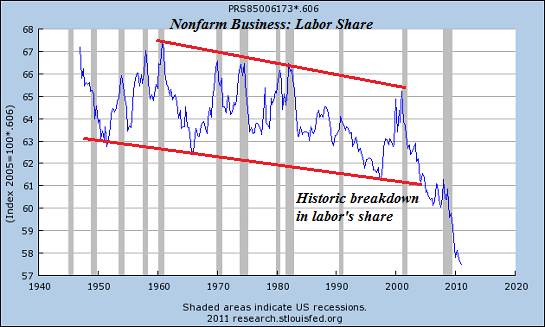

We like to think that modern economies have escaped this cycle, but that is hubris and denial, not reality, for the 20th and early 21st centuries have been characterized by inflation (the U.S. dollar has lost approximately 96% of its value since 1900) and wages have stagnated for the past 40 years:

Soaring Poverty Casts Spotlight on ‘Lost Decade’:

According to the Census figures, the median annual income for a male full-time, year-round worker in 2010 — $47,715 — was virtually unchanged, in 2010 dollars, from its level in 1973, when it was $49,065.Overall, median household income adjusted for inflation declined by 2.3 percent in 2010 from the previous year, to $49,445. That was 7 percent less than the peak of $53,252 in 1999.

We can see this steady decline in wages in this chart:

The more recent fall-off is depicted in this chart:

Notice that the only age bracket with rising incomes is the 65 and over cohort; everyone younger than 65 has seen their income slashed. And this is assuming "official" inflation is accurate; if it understates real inflation (loss of purchasing power), then the income declines are actually much more severe than charted here.

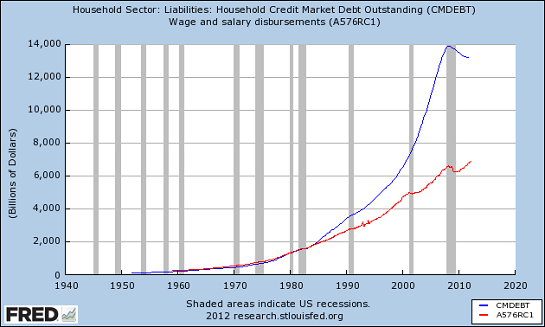

As I have observed many times before, the middle class filled this gap between rising costs and stagnating wages with debt. This chart reflects this reality:

Household debt has soared far above wages. (Note that this chart is not adjusted to inflation; in real terms, wages have been flat for decades).

Now that the average household is heavily indebted with student loans, vehicle loans, credit card debt and mortgages, its ability to leverage a declining income into more debt is seriously impaired. So filling the gap between rising costs and declining wages with debt is no longer a possibility.

Living within their means and servicing their mountains of debt removes most families from the middle class. As a rough metric, I define middle class as any household with the following attributes:

1. Meaningful healthcare insurance, either provided by an employer or paid by the household

2. Significant equity in a home or other real estate

3. An income and expense sheet that enables the household to save at least 6% of its income

4. Significant retirement funds, either employer-provided or 401Ks, IRAs, income property, etc.

5. The ability to service all debt and expenses over the medium-term if one of the two primary household wage-earners lose their job, i.e. either the household has significant savings or its debts are modest compared to the household income.

Anything less than this basket of attributes is too precarious to qualify as middle class. These basics of financial security were standard-issue for the middle class in the postwar era.

A household could have all of the above attributes on an annual income of $40,000, or they may not have them with an income of $80,000, as "middle class" means some measure of financial security, i.e. owning assets and carrying a debt load that isn't large enough to crush the household balance sheet if income declines.

We can further understand the precariousness of many American households by examining IRS tax data. The top 25% of taxpayers--34 million workers out of a workforce of 160 million and 140 million wage earners--pay almost 90% of all Federal income taxes.

Where Do You Rank as a Taxpayer?

An adjusted gross income (AGI) of $66,193 or more puts you in the top 25% of earners. The top-earning 25% of taxpayers reported 65.81% of all AGI and paid 87.30% of total federal income taxes ( $755.9 billion).How much do you need to make to be in the top 50% of earners? Just $32,396. Fall below that level and you are in the bottom half, along with nearly 70 million of your fellow taxpayers. All told, that group earned just 13% of the income reported on 2009 tax returns. And they coughed up 2.25% of all the income taxes paid.

If we dig into the data, we find that the top 25% (34 million workers) is really the top 33%, as only 104 million tax returns actually pay any Federal tax--and as noted above, the bottom 70 million paid a scant 13% of all Federal taxes while the top 34 million paid 87% of all income taxes.

In 2009, the IRS reported 140.5 Million personal income tax returns were filed. From this starting point, 36.3 Million returns (or, one quarter of the total) are lost to the tax base because of losses, exclusions or deductions. By line 43, taxable income, only 104.2 Million returns survive. In aggregate dollar amounts, total income from all sources falls from $7.7 Trillion to $5.1 Trillion — a decline of more than one-third. This latter amount is what truly constitutes the tax base, since it is the income ultimately subjected to tax.

Of course Social Security taxes are paid by low-income workers, but this amounts to 7.6% of income--not zero, but not too punishing compared to Federal tax rates.

What all this reveals is that the middle class has lost its political power. Roughly 40% of all households receive a check or equivalent from the Federal government, while at the top Power Elite crony capitalists skim capital gains and pay an average of 17% of all income.

The 100 million dependents on the Federal government (Central State) vote to support their share of the largesse, regardless of the consequences to future generations, and the Power Elite crony capitalists buy political protection for their cartels and financialization scams. The dwindling middle class ends up paying most of the taxes even as their percentage of the population falls to the point that their political voice is drowned out by more numerous dependents and Elites that both favor the Status Quo.

The Federal government is supporting its dependents and its crony-capitalist Elites with borrowed money: $1.5 trillion every year, fully 40% of the Federal budget. It is in effect filling the gap between exploding costs and declining income, just like the middle class did until they ran out of collateral to leverage.

The dwindling middle class, now at best perhaps 25% of the workforce, has been reduced to tax donkeys supporting those above and below who are dependent on Federal largesse.

Fisher found that this cycle ends in transformational political upheaval. No wonder; even as the class paying most of the taxes shrinks and is pressured by higher costs, the class of dependents expands as the economy deteriorates and the super-wealthy Power Elites continue to control the levers of Central State power.

I address these dynamics in various ways in all my books:

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.

We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: though our financial system seems unsinkable, its reliance on debt and financialization has already doomed it.We cannot know when the Central State and financial system will destabilize, we only know they will destabilize. We cannot know which of the State’s fast-rising debts and obligations will be renounced; we only know they will be renounced in one fashion or another.

The process of the unsustainable collapsing and a new, more sustainable model emerging is called revolution, and it combines cultural, technological, financial and political elements in a dynamic flux.History is not fixed; it is in our hands. We cannot await a remote future transition to transform our lives. Revolution begins with our internal understanding and reaches fruition in our coherently directed daily actions in the lived-in world.

| Thank you, Dominic V. ($20), for your superbly generous contribution to this site--I am greatly honored by your support and readership. | | Thank you, Kendall H. ($5/month), for your splendidly generous subscription to this site--I am greatly honored by your support and readership. |

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.

Resistance, Revolution, Liberation will be available in a print edition later in April; buy it now as a Kindle eBook for $9.95.