The "narrative" of Greece is simple: no entity, be it a household or nation, can live beyond its means indefinitely.

Imagine a ship with 100 passengers and crew drifting down a river that eventually cascades over a 1,000 foot waterfall. It's easy to plot the ship's course and the waterfall ahead. You might think 100% of those onboard would agree that something drastic must be done to either reverse course or abandon ship, but before we jump to any conclusion we must first identify what each of the 100 people perceive as serving their self-interest.

If life onboard is good for 55 of the 100, they may well rationalize away the waterfall dead ahead. Indeed, they might vote to maintain the current course, thus dooming the 45 others who can hear the thundering cascade ahead but who are powerless to change course in a democracy.

This is the "tyranny of the majority" feared by some of the American Founding Fathers. I cannot locate reliable statistics on what percentage of the Greek population is dependent on the State for a paycheck, entitlement, retirement, disability, unemployment, etc., but I suspect the number exceeds the full-time private payroll of that nation. It seems likely that the number of voters in Greece who draw a check or benefit from the State exceeds the number of privately employed voters whose perception of self-interest is radically at odds with continuing State borrowing to fund the Status Quo.

If 55% of the voting public is dependent on government spending, then they will vote to continue that spending regardless of its unsustainability.

This is a variation of The Tragedy of the Commons, where the self-interest of each individual is served by stripmining the public commons for their individual gain. When everyone sees the commons as "free for the taking," then the commons is soon destroyed for all.

To the degree that Central State revenue is a form of public commons, then the siphoning of that resource to serve individual gain leads to the loss of the commons, as well as the loss of any notion of the "common good."

With 55 of the 100 voting to continue the present course of State borrowing and spending to support their piece of the largesse, the ship is doomed to end up in pieces at the bottom of the waterfall, despite the utter obviousness of the catastrophe just ahead.

Self-interest is often distorted or short-sighted, something I analyze in depth in

Resistance, Revolution, Liberation: A Model for Positive Change, for without an understanding of distorted self-interest, we cannot understand why people will continue supporting a visibly imploding Status Quo: they will do so as long as they are getting a "free" piece of that Status Quo.

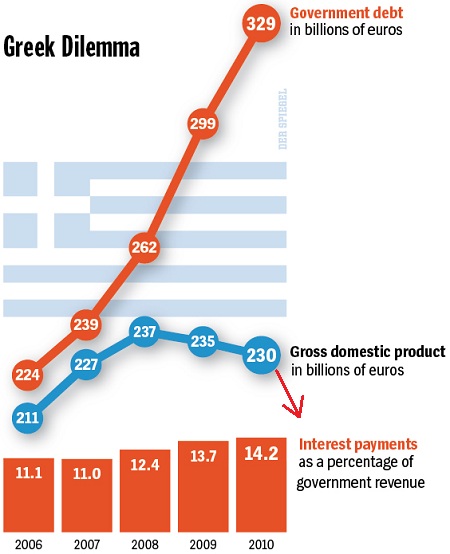

This chart is a bit dated, but the trends haven't changed. According to Wikipedia's

entry on Greece's economy, public debt is now $355 billion and its GDP is $215 billion, though those numbers have probably drifted higher/lower along these trendlines:

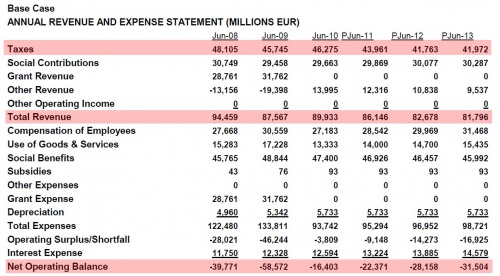

Here is Greece's Central State budget, which sports an annual deficit of roughly 10% of GDP. This is about the same as the U.S., but the U.S. has the privilege of printing/ borrowing its own currency into existence. Greece does not have the luxury of printing euros. It seems likely these tax revenue figures are wildly optimistic, and so the actual current deficit is probably much higher.

Most of those collecting a piece of the 96 billion euros in annual State spending appear to have voted to keep the ship firmly heading for the waterfall, because they fear the consequences of changing course or abandoning ship. A "tyranny of the majority" voted by all the recipients of Status Quo deficit-spending is a form of farce, while the chosen course--off the waterfall--is a tragi-comedy.

There is only one productive path forward for Greece:

1. Renounce the unpayable debt and cease paying interest on all sovereign debt.

2. Live within the means generated by the nation's enterprises and workers.

3. Stop consuming/living off borrowing money.

A government can only spend the surplus generated by the nation's private sector. Ultimately, all government expenditures are paid from the surplus generated by the private sector. If that surplus is modest, then government expenditures must be modest as well.

This means that all those individuals who have been paid with borrowed funds will experience a decline in their State-provided income when the borrowing ceases. The "standard of living" will decline until the cost-basis of the economy declines as demand contracts.

When street upon street of commercial spaces are vacant, eventually the owners of those empty spaces will go bankrupt or lower the rents to what the economy can sustain. This reduction in price from a decline in demand plays out in a number of domestically supplied cost structures.

The "narrative" of Greece is simple: no entity, be it a household or nation, can live beyond its means indefinitely. If consumption is paid by borrowing, eventually the interest payments on that ever-rising debt feed a financial death-spiral of ever-higher interest, taxes, austerity and ever-declining investment in productive assets.

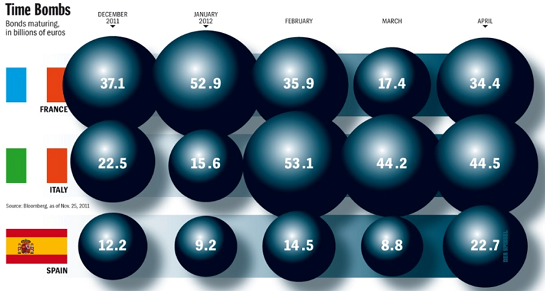

Greece is not alone in living beyond its means. This chart is a bit dated, but it usefully poses this question: if these massive bond maturations continue month after month as far as the eye can see, exactly what miracle source will roll over all this debt *and* fund the vast new debt that is sold every year to fund massive deficit spending by these nations?

The Chinese have an apt saying: when you're thirsty, it's too late to dig a well. We're not yet thirsty in America, so we have no interest in digging a well. That's a bother; it's so much easier to borrow 10% of our GDP every year to fund our deficit spending. We too face a "tyranny of the majority:" there are only 115 million full-time private-sector jobs in the U.S., and a far greater number of recipients of government funding who will vote to continue their share of the borrowed money, regardless of the waterfall just ahead.

The double-feature farce and tragi-comedy is currently playing at the Greek Theater, but it will soon be opening in every debt-dependent nation on the planet.

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

(Kindle eBook $9.95)

We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: though our financial system seems unsinkable, its reliance on debt and financialization has already doomed it.We cannot know when the Central State and financial system will destabilize, we only know they will destabilize. We cannot know which of the State’s fast-rising debts and obligations will be renounced; we only know they will be renounced in one fashion or another.

The process of the unsustainable collapsing and a new, more sustainable model emerging is called revolution, and it combines cultural, technological, financial and political elements in a dynamic flux.History is not fixed; it is in our hands. We cannot await a remote future transition to transform our lives. Revolution begins with our internal understanding and reaches fruition in our coherently directed daily actions in the lived-in world.

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)